Real Estate Taxes In South Dakota . the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Local governments, such as municipalities and school districts, set tax rates. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Ad valorem refers to a tax imposed on. this article highlights geographic trends in property tax rate changes at the county level over the last. Compare your rate to the south dakota and u.s. this portal provides an overview of the property tax system in south dakota. The portal offers a tool that explains how local. south dakota has a fairly straightforward property tax system.

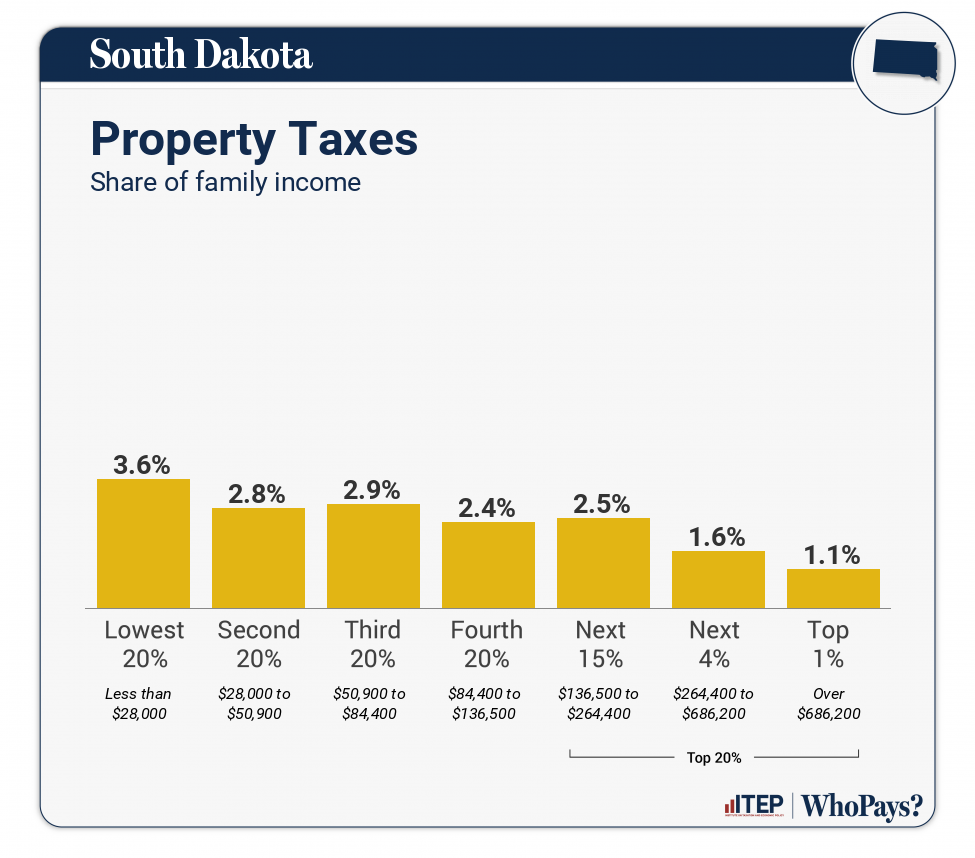

from itep.org

the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. south dakota has a fairly straightforward property tax system. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Local governments, such as municipalities and school districts, set tax rates. this article highlights geographic trends in property tax rate changes at the county level over the last. this portal provides an overview of the property tax system in south dakota. The portal offers a tool that explains how local. Compare your rate to the south dakota and u.s.

South Dakota Who Pays? 7th Edition ITEP

Real Estate Taxes In South Dakota Ad valorem refers to a tax imposed on. Ad valorem refers to a tax imposed on. Compare your rate to the south dakota and u.s. this article highlights geographic trends in property tax rate changes at the county level over the last. the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. this portal provides an overview of the property tax system in south dakota. The portal offers a tool that explains how local. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Local governments, such as municipalities and school districts, set tax rates. south dakota has a fairly straightforward property tax system. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value.

From ellsworthcochran.blogspot.com

south dakota property tax due dates Ellsworth Cochran Real Estate Taxes In South Dakota the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. this portal provides an overview of the property tax system in south dakota. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. this article highlights geographic trends. Real Estate Taxes In South Dakota.

From itep.org

South Dakota Who Pays? 6th Edition ITEP Real Estate Taxes In South Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. south dakota has a fairly straightforward property tax system. Compare your rate to the south dakota and u.s. Ad valorem refers to a tax imposed on. Local governments, such as municipalities and school districts, set tax rates. this article. Real Estate Taxes In South Dakota.

From fideliaupchurch.blogspot.com

south dakota property tax abatement Fidelia Upchurch Real Estate Taxes In South Dakota The portal offers a tool that explains how local. south dakota has a fairly straightforward property tax system. this article highlights geographic trends in property tax rate changes at the county level over the last. Ad valorem refers to a tax imposed on. Local governments, such as municipalities and school districts, set tax rates. calculate how much. Real Estate Taxes In South Dakota.

From www.pinterest.com

Chart 4 South Dakota Local Tax Burden by County FY 2015.JPG South Real Estate Taxes In South Dakota The portal offers a tool that explains how local. Compare your rate to the south dakota and u.s. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Ad valorem refers to. Real Estate Taxes In South Dakota.

From southdakotasearchlight.com

‘Somebody has to pay, ultimately’ Legislative committee begins study Real Estate Taxes In South Dakota Local governments, such as municipalities and school districts, set tax rates. The portal offers a tool that explains how local. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. the median property tax in south dakota is $1,620.00 per year for a home worth the median. Real Estate Taxes In South Dakota.

From taxfoundation.org

How Does Your State Rank on Property Taxes? 2019 State Rankings Real Estate Taxes In South Dakota this portal provides an overview of the property tax system in south dakota. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. The portal offers a tool that explains how local. Ad valorem refers to a tax imposed on. Local governments, such as municipalities and school districts, set tax. Real Estate Taxes In South Dakota.

From kxrb.com

This South Dakota County Has the Highest Property Taxes Statewide Real Estate Taxes In South Dakota Local governments, such as municipalities and school districts, set tax rates. this portal provides an overview of the property tax system in south dakota. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. Ad valorem refers to a tax imposed on. The portal offers a tool that explains how. Real Estate Taxes In South Dakota.

From latashiaporterfield.blogspot.com

south dakota sales tax rates by city Latashia Porterfield Real Estate Taxes In South Dakota the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. this article highlights geographic trends in property tax rate changes at the county level over the last. Local governments, such as municipalities and school districts, set tax rates. south dakota has a fairly straightforward property tax. Real Estate Taxes In South Dakota.

From www.taxuni.com

South Dakota State Taxes Guide Real Estate Taxes In South Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature.. Real Estate Taxes In South Dakota.

From itep.org

South Dakota Who Pays? 7th Edition ITEP Real Estate Taxes In South Dakota The portal offers a tool that explains how local. this portal provides an overview of the property tax system in south dakota. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Ad valorem refers to a tax imposed on. this article highlights geographic trends in. Real Estate Taxes In South Dakota.

From my-unit-property-9.netlify.app

Real Estate Property Tax By State Real Estate Taxes In South Dakota Local governments, such as municipalities and school districts, set tax rates. the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. The portal offers a tool that explains how local. south dakota has a fairly straightforward property tax system. the amount of tax you pay is determined. Real Estate Taxes In South Dakota.

From itep.org

South Dakota Who Pays? 6th Edition ITEP Real Estate Taxes In South Dakota Compare your rate to the south dakota and u.s. The portal offers a tool that explains how local. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota legislature. Ad valorem refers to a tax imposed on. south dakota has a fairly straightforward property tax system. this. Real Estate Taxes In South Dakota.

From southdakotasearchlight.com

‘Somebody has to pay, ultimately’ Legislative committee begins study Real Estate Taxes In South Dakota Compare your rate to the south dakota and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Local governments, such as municipalities and school districts, set tax rates.. Real Estate Taxes In South Dakota.

From 973kkrc.com

This South Dakota County Has Highest Property Tax In Whole State Real Estate Taxes In South Dakota Ad valorem refers to a tax imposed on. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. Compare your rate to the south dakota and u.s. the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. Local governments, such. Real Estate Taxes In South Dakota.

From dxobnrmds.blob.core.windows.net

Lincoln County Property Taxes South Dakota at Carol Stanley blog Real Estate Taxes In South Dakota Local governments, such as municipalities and school districts, set tax rates. Compare your rate to the south dakota and u.s. calculate how much you'll pay in property taxes on your home, given your location and assessed home value. the property tax is an ad valorem tax on all property that has been deemed taxable by the south dakota. Real Estate Taxes In South Dakota.

From dxoiodrih.blob.core.windows.net

Dakota County Property Tax Homestead at Wilson Womack blog Real Estate Taxes In South Dakota The portal offers a tool that explains how local. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. this portal provides an overview of the property tax system in south dakota. this article highlights geographic trends in property tax rate changes at the county level over the last.. Real Estate Taxes In South Dakota.

From gioiggkkm.blob.core.windows.net

South Dakota Real Estate Taxes at Ellen Levy blog Real Estate Taxes In South Dakota calculate how much you'll pay in property taxes on your home, given your location and assessed home value. south dakota has a fairly straightforward property tax system. Ad valorem refers to a tax imposed on. the median property tax in south dakota is $1,620.00 per year for a home worth the median value of $126,200.00. The portal. Real Estate Taxes In South Dakota.

From dxobnrmds.blob.core.windows.net

Lincoln County Property Taxes South Dakota at Carol Stanley blog Real Estate Taxes In South Dakota Compare your rate to the south dakota and u.s. the amount of tax you pay is determined by multiplying your tax rate by your property’s taxable value. this article highlights geographic trends in property tax rate changes at the county level over the last. The portal offers a tool that explains how local. Ad valorem refers to a. Real Estate Taxes In South Dakota.